Cost recovery deduction calculator

You cannot use the standard mileage rates if you claim vehicle depreciation under the Modified Accelerated Cost Recovery System MACRS. You must not have claimed actual expenses after 1997 for a car you lease.

Macrs Depreciation Calculator Irs Publication 946

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

. NW IR-6526 Washington DC 20224. With this handy calculator you can calculate the depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. However if the depreciation under ACRS is greater in the first year than the depreciation under MACRS you must.

It means a business can save 1 in taxable profits for every 1 spent up to a maximum of 1m per tax year. Bonus depreciation remains at 100 until January 1 2023. Recovery limited to deduction.

Temporary 100 deduction of the full meal portion of a per diem rate or allowance. However it is an allowable deduction against profit. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

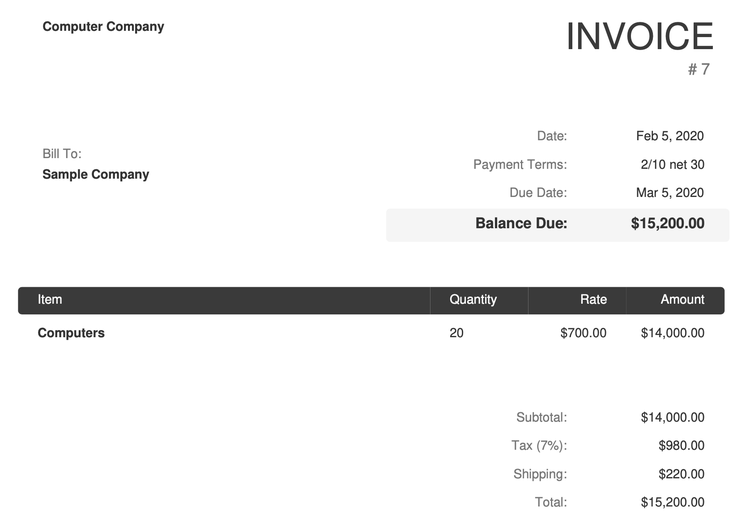

The 2employee fee is charged per unique active employee that has run a payroll during the monthly billing cycle. Cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly lower the true cost of the equipment purchased financed or leased. Overall limitation on itemized deductions no longer applies.

A 100 deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. We welcome your comments about this publication and your suggestions for future editions. Section 179 deductions speed up the deduction taking all of the cost as a deduction in the first year.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Generally you itemize deductions on Schedule A of your tax return if your itemized deductible expenses for the year exceed the standard deduction. Claiming the deduction requires you to complete IRS Form 4684.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Sigourney Weaver on her unpredictable career With more than 60 film credits including four movies debuting this fall Sigourney Weaver seems to have found her place and at her own steady pace. Section 179 deduction dollar limits.

Mortgage loan basics Basic concepts and legal regulation. Updated Section 179 for 2022 Deduction information plus bonus depreciation. You must not have claimed a depreciation deduction for the car using any method other than straight-line You must not have claimed a Section 179 deduction on the car You must not have claimed the special depreciation allowance on the car and.

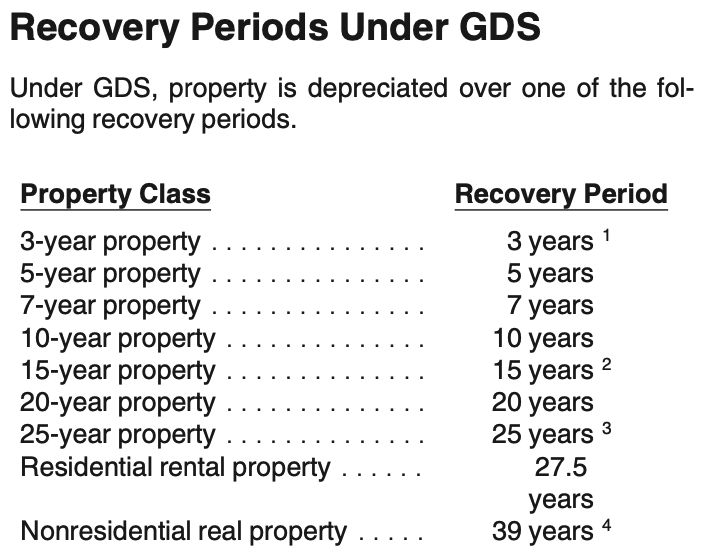

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The total cost of purchasing and placing the asset in service less any amount being deducted as a Section 179 expense or bonus depreciation. Most equipment is either a five- or seven-year.

Take a section 179 deduction for the full cost of the office furniture. Super-deduction calculator. Under Section 179 you can claim a deduction in the current year.

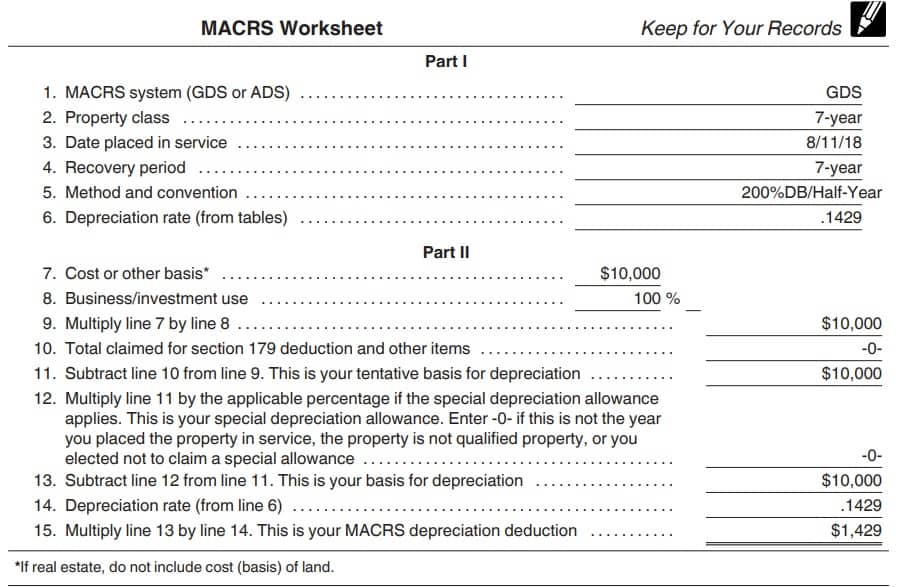

By which the cost of section 179 property placed in serv-ice during the tax year exceeds 2620000. Use this quick health insurance tax credit guide to help you understand the process. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value.

1980 and before 1987 and change it to business use in 2021 you generally depreciate the property under the accelerated cost recovery system ACRS. See 50 Limit in chapter 2 for more information. The 3-year recovery period for race horses 2 years old or younger will.

You can claim the Section 179 deduction when you placed these types of property into service during the tax year. Computations for Worksheet 2 lines 1a and 1b. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

The life assigned to your asset by the MACRS rules is discussed more here. Best Tax Software Best Tax Software For The Self-Employed 2021-2022 Tax Brackets Tax Calculator Cryptocurrency Tax Calculator Capital Gains Tax Calculator Credit Score. A Section 179 deduction allows you to deduct the full cost of the asset as an expense rather than deprecate and deduct it over several years.

National Health Insurance Levy NHIL 25. Her standard deduction would be 14250. For 2021 she gets the normal standard deduction of 12550 plus one additional standard deduction of 1700 for being over the age of 65.

However the amount you can exclude is limited to your employers cost and cant be more than 1600 400 for awards that arent qualified plan awards for all such awards you receive. However if the casualty loss is not the result of a federally declared disaster you must be itemize your deductions to claim the loss. You need the following information to use our calculator.

2022 Tax Calculator Estimator - W-4-Pro. Qualified tangible personal property. In addition to taking a Section 179 deduction you may also be able to take an additional first-year bonus depreciation of 100 on business property that is new to your business.

This 2022 Section 179 Deduction Calculator will instantly show how much money you can save when you buy lease or finance equipment this year. The deduction can also apply to prescription drugs used to ease nicotine withdrawal. Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace.

Value Added Tax VAT Standard Rate 125. Youd do this by deducting all or a portion of the cost of certain property as opposed to depreciating it. Plain-English information on deducting the full cost of new or used qualifying equipment software and vehicles purchased or financed.

Recovery period for certain race horses. The annual investment allowance AIA lets a business deduct 100 of the cost of qualifying plant and machinery assets from their taxable profit in the tax year of purchase. Or just use one of the ObamaCare subsidy calculators found below for a quick estimate on marketplace cost assistance.

Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years begin-ning in 2021 is 26200. The COVID-19 Health Recovery Levy Act 2021 Act 1068 imposes a special levy on the supply of goods and services and the Import of goods and services into Ghana. Upon activation of the QuickBooks Online Payroll service your subsequent monthly charges will be 20 2employee in addition to your QuickBooks Online subscription cost plus all applicable taxes until you cancel.

In our example 75000 in. Disaster recoveryIf a taxpayers home is affected by a natural disaster and the taxpayer requires federal aid. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

A 100 deduction is allowed for certain business meals paid or incurred after 2020 and before 2023.

Macrs Depreciation Table Calculator The Complete Guide

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Depreciation And Cost Recovery Half Year Convention Tax Cuts And Jobs Act Of 2017 Macrs Youtube

Applying Real Estate Investment Concepts Calculating Cost Recovery Deductions Ryan Rauner S Real Estate Blog

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Calculator Based On Irs Publication 946

Applying Real Estate Investment Concepts Calculating Cost Recovery Deductions Ryan Rauner S Real Estate Blog

Macrs Meaning Importance Calculation And More

Depreciation Macrs Youtube

10 Employment Verification Forms Word Excel Pdf Templates Employment Form Good Essay Job Letter

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Macrs Depreciation Calculator Irs Publication 946

Declining Balance Depreciation Calculator

Modified Accelerated Cost Recovery System Macrs A Guide

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Modified Accelerated Cost Recovery System Macrs A Guide

Calculate Your Tax Savings With Limited Amount Of Effort Using Bonus Depreciation Calculator Federal Income Tax Tax Reduction Income Tax Saving